FRM vs CFA: Which Path Speaks to You?

CFA – The Investor’s Credential

The CFA program is often called the gold standard for investment professionals. It’s deep, challenging, and covers everything from equity analysis to portfolio management. If you’re someone who gets excited about stock markets, valuations, or managing wealth, the CFA is built for you. What makes it even more relevant today is how the program has evolved. The CFA Institute has added Practical Skills Modules—like Python, financial modeling, and portfolio construction—so that students don’t just pass exams, they gain tools that employers actually use.

And there’s momentum here too: according to the 2025 Graduate Outlook Survey, finance has become the top career of choice worldwide, with more than a third of graduates saying they see themselves in this field. That’s a huge leap from just two years ago, and it shows young people trust finance not only for stability but also for impact.

FRM – The Risk Specialist

FRM, on the other hand, is more specialized. It’s designed for people who want to master risk management—whether that’s credit risk in a bank, market risk in a trading firm, or operational risk in a fintech. With global uncertainty, climate risks, and new technologies constantly reshaping the industry, risk professionals are in demand everywhere. In India, too, banks and consulting firms are actively hiring FRMs to strengthen their governance and compliance functions. If you like spotting problems before they happen and protecting businesses against shocks, FRM could feel like your calling.

The Financial Risk Manager (FRM) designation, offered by the Global Association of Risk Professionals (GARP), has steadily gained recognition as organizations worldwide place greater emphasis on risk management. Once considered a niche qualification, FRM is now moving into the mainstream, thanks to growing demand from banks, regulators, and corporates for professionals who can navigate uncertainty.

In recent years, risk has become more complex—ranging from market volatility and credit exposure to operational threats like cybersecurity and climate risk. This environment has made the FRM credential increasingly relevant. According to GARP’s latest reports, the number of FRM candidates globally has grown at double-digit rates since 2020, with Asia leading the surge. India, in particular, has emerged as a hotspot, reflecting the country’s booming financial services sector and stricter compliance requirements from the Reserve Bank of India (RBI) and SEBI.

Industry demand backs this up. Top Indian employers such as ICICI Bank, HDFC, Deloitte, and KPMG now list FRM certification as a preferred qualification for roles in risk analysis, treasury, and compliance. Multinational firms like JP Morgan and HSBC are also expanding their risk teams in India, offering opportunities that were once limited to global hubs like London or New York.

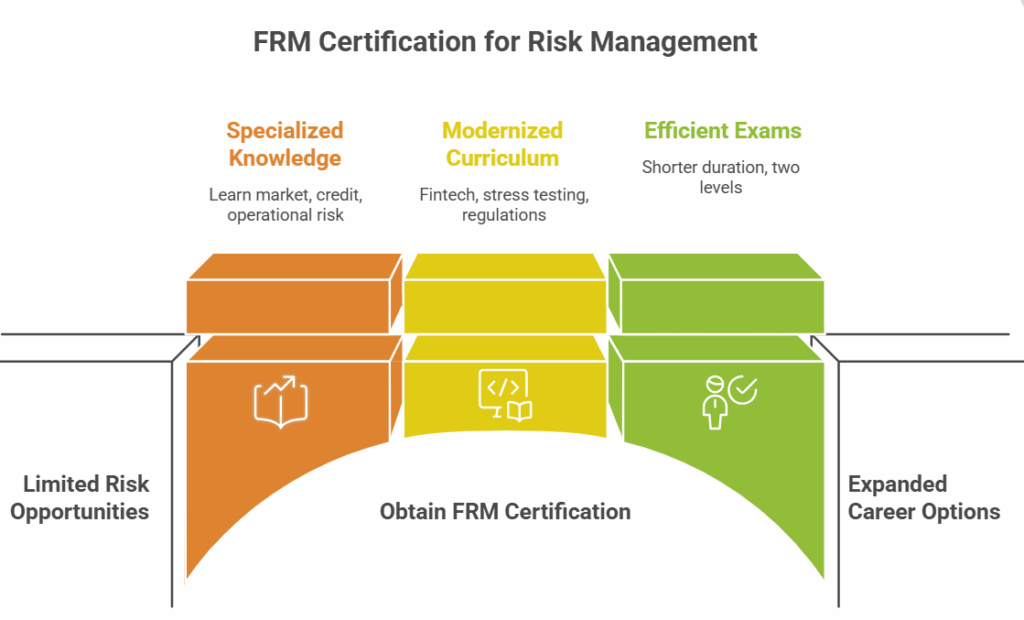

Unlike the CFA, which focuses broadly on investment and portfolio management, the FRM is highly specialized. It equips candidates with practical knowledge in market, credit, operational, and liquidity risk, making it a natural fit for careers in risk advisory and financial governance. The two levels of exams are demanding but shorter in duration compared to multi-year programs, allowing motivated candidates to complete the credential relatively quickly.

GARP has also modernized its curriculum to stay relevant. Modules on fintech risk, stress testing, and regulatory frameworks have been added, reflecting how rapidly risk management is evolving. This adaptability ensures that the FRM remains a forward-looking qualification, aligned with the realities of today’s financial markets.

Despite being more specialized, the FRM’s growing prestige highlights a clear industry shift: in a world where growth and stability must coexist, risk managers are no longer seen as back-office support but as central players in strategic decision-making. For India’s youth, the FRM offers not only career security but also a chance to contribute meaningfully to safeguarding financial systems in an unpredictable world.