CPA vs CFA: Two Powerful Credentials, Two Different Journeys

The Certified Public Accountant (CPA) and the Chartered Financial Analyst (CFA) designations are often mentioned together, but they serve very different purposes in the finance world. Both carry global recognition and prestige, yet their industry relevance, candidate pools, and career trajectories diverge sharply.

CPA – Accounting’s Global Passport

The CPA is widely seen as the gold standard in accounting, auditing, and taxation. Its roots are strongest in the United States, but multinational companies worldwide rely on CPA-qualified professionals to ensure compliance with US GAAP and IFRS. Industry demand is currently surging: the U.S. faces a “significant and growing shortage” of accountants, prompting firms to recruit talent from abroad, especially India. This shortage has created an unprecedented window of opportunity for Indian candidates who can qualify and fill roles in Big Four firms, corporate finance, and multinational subsidiaries.

The CPA path is structured but relatively quick to complete compared to other qualifications, making it attractive to students who want to specialize early and enter high-demand roles. Typical career outcomes include auditor, controller, financial accountant, and tax consultant.

CFA – The Investor’s Credential

By contrast, the CFA is deeply embedded in the world of investments, asset management, and capital markets. Its curriculum spans equity valuation, fixed income, derivatives, portfolio management, and ethics. For decades, the CFA charter has been the “gold ticket” into investment banking, wealth management, and equity research.

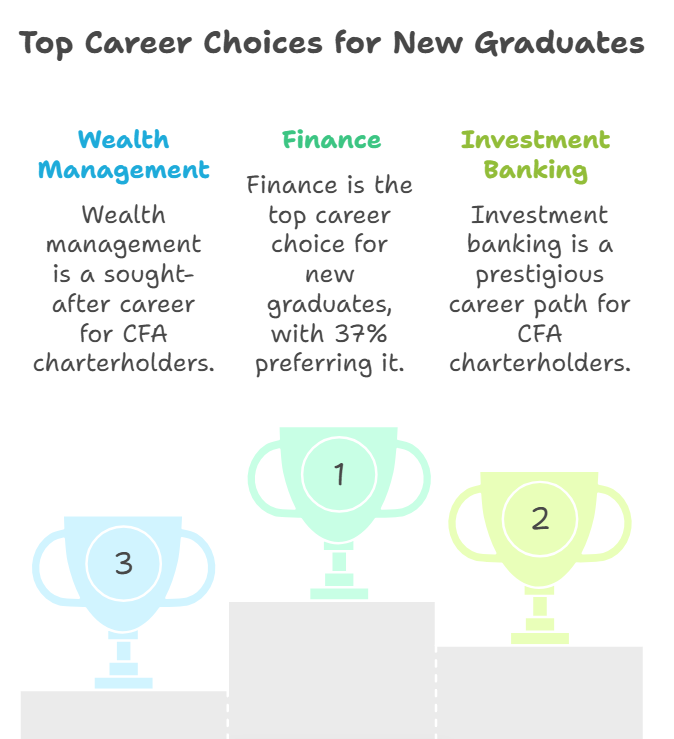

While candidate numbers globally have dipped since the pandemic, the CFA Institute’s 2025 Graduate Outlook Survey shows finance has become the top career choice among new graduates, with 37% preferring it—up from 24% in 2023. India has been a bright spot in registrations, offsetting declines in regions like China. The CFA Institute has also updated its content to include cryptocurrency case studies, ESG, and Python-based financial modeling, ensuring the charter remains relevant in today’s markets.

Industry Perception

From an industry perspective, CPA professionals are viewed as guardians of financial accuracy, essential for regulatory compliance and trustworthy reporting. CFA charterholders are seen as investment strategists, guiding portfolios and capital allocation in a fast-changing financial world.

For young professionals, the decision between CPA and CFA comes down to passion: if you’re drawn to accounting, audit, and compliance, CPA offers a clear and stable path. If your heart beats for markets, investments, and valuation, the CFA gives you a global platform to build your career.